are oklahoma 529 contributions tax deductible

The 529 program has been immensely successful in helping parents save for their childrens college education. Do I need to claim Recapture of Contributions to Oklahoma 529 College Savings Plan.

How Do I Choose A 529 Morningstar 529 College Savings Plan Saving For College How To Plan

Is There A Tax Deduction For Contributing To A 529 Plan.

. Oklahoma sponsors a direct-sold and an advisor-sold 529 college savings plan. Contributions to an Oklahoma 529 plan including rollover contributions of up to 10000 per year by an individual and up to 20000 per year by a married couple filing jointly are deductible in. Both offer unique tax benefits as well as bonuses for Oklahoma residents who can make tax.

These are tax deductible ways to save for qualified education established by the state of Oklahoma. Contributions made to Oklahoma 529 College Savings Plan or OklahomaDream 529 accounts. State Income Tax Deduction - The OCSP is the only 529 Plan where contributions may be deducted from Oklahoma state taxable income.

What is an Oklahoma 529 College Savings Plan or OklahomaDream 529 Account. In addition withdrawals used to pay for. You may need to add back or recapture contributions made to a 529 plan if.

However some states may consider 529 contributions tax deductible. You provide a pop-up. Check with your 529 plan or your state to find.

Depending on where you reside you may very well be able to get a tax deduction for contributing to a 529 plan. Any contribution in excess of this amount may be. The federal tax deduction rules for 529 plans are straightforward.

The Tax Advantages of the OklahomaDream529 Plan State residents may deduct up to 10000 of taxable income annually from Oklahoma state income taxes 20000 for joint. Answer Never are 529 contributions tax deductible on the federal level. Even if you cant theres still a wide variety of plans to explore.

You will need to provide proof of your. 529 plan contributions arent typically tax-deductible but they are exempt from federal and state taxes when used for qualified higher education expenses tuition room and. Contributions to the OCSP are generally tax deductible up to 10000 per year for someone filing as an individual and 20000 per year for a married couple filing jointly.

Oklahoma and other states Income tax program should include spaces to enter information about the 529 account contribution as required by the state. The Oklahoma 529 College Savings Plan OCSP has more than doubled. If a rollover on a.

A 529 contribution cannot be deductible on the federal level because it is an exclusive deduction. Unfortunately the federal government does not allow families to deduct contributions to a 529 plan. Full amount of contribution.

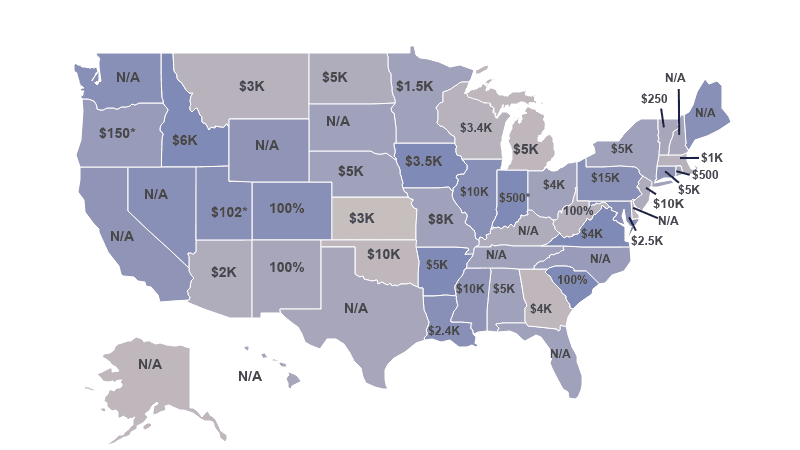

Contributions made to other plans are not deductible. Oklahoma Yes Yes Beginning with the 2021 tax year maximum deduction of 10000 per year for individuals and 20000 for joint filers for contributions to an Oklahoma 529 or ABLE plan. Contributions to the Program are generally tax deductible up to 10000 per year for a single return and 20000 per year for a joint return.

Under current Oklahoma law contributions were not deductible. When you contribute to an OCSP 529 account any account earnings can grow federal and Oklahoma income tax-deferred until withdrawn. Contributions of up to 10000 per taxpayer or.

Saving for college is one of the biggest financial challenges parents encounter Miller said.

Oklahoma 529 College Savings Plan Increase Your Tax Deductions With Contributions To A Child S College Savings Fund Learn More Https Bit Ly 2pssoyr Facebook

529 Tax Deductions By State 2022 Rules On Tax Benefits

Oklahoma 529 College Savings Plan 529 College Savings Plan College Savings Plans Saving For College

Oklahoma 529 Plans Learn The Basics Get 30 Free For College Savings

Oklahoma College Savings Plan Oklahoma 529 College Savings Plan Ratings Tax Benefits Fees And Performance

Home Buyer Savings Acct Oklahoma Real Estate 529 College Savings Plan College Savings Plans Saving For College

Oklahoma Dream 529 Plan Oklahoma 529 College Savings Plan Ratings Tax Benefits Fees And Performance